3 Strategies for Successful Insurance Lead Generation and Nurturing

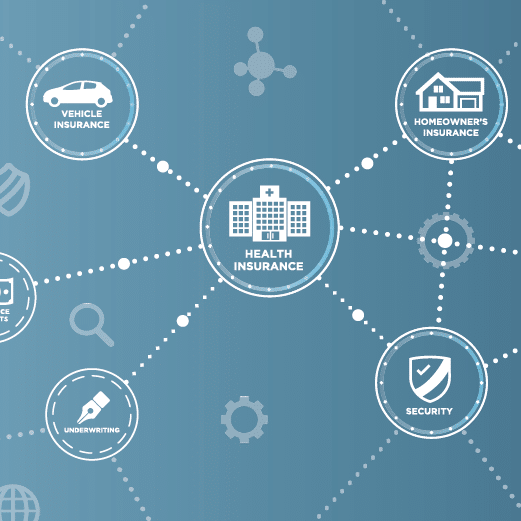

Lead generation and lead nurturing are essential components of a steady and successful sales pipeline for insurance providers. Generating leads gives brokers, carriers, and managing general agents (MGAs) an opportunity to drive new business. Lead nurturing maximizes the investment in that effort by allowing providers to develop relationships with qualified leads.

Despite the importance of lead generation and lead nurturing, 61% of insurance marketers struggle to succeed in these areas. Insurance providers who want to stay ahead of the competition must navigate this challenge.

Below, we explore the main challenges with lead generation and nurturing and provide three strategies to help insurance marketers get the most out of their efforts in these areas.

Key challenges in lead generation and lead nurturing

Driving qualified leads and converting them into sales is the top priority for insurance marketers. However, achieving success in lead generation and nurturing can take time and effort. The following statistics best illustrate the main challenges related to leads in the insurance landscape:

50% of leads are qualified but not ready to buy: Nurturing programs are essential in order to stay top of mind for when qualified leads do become ready to buy.

25% of leads are legitimate and should advance to sales: The biggest task for insurance marketers is to leverage technology-enabled programs that will make it easier to identify and nurture legitimate leads, and only send them to sales when ready.

79% of marketing leads never convert into sales: Relationship building nurtures are central to driving value propositions and being ready for those leads who drive revenue.

Successful strategies for lead generation and lead nurturing

When insurance providers sell their products online, they often make the mistake of believing that leads will convert on the very first contact. This makes them neglect the importance of lead nurturing, which is key to long-term success.

Research shows that nurtured leads produce 20% more qualified sales opportunities. These are some guidelines for what you should keep in mind when crafting your lead generation and nurturing campaign:

1. Review lead flow to maximize successful conversion

Lead flow focuses on the customer experience with a provider’s capture and conversion process and may include different digital channels including email, website or social. A customer may touch several of these channels in their path from discovery through to conversion. By reviewing these touchpoints, Insurance providers can learn how and where customers prefer to engage and identify roadblocks that may make the customer journey more difficult. Changes may include optimizing website pages, modifying fields in contact or lead capture forms or clarifying content and CTAs (calls to action) in emails. By removing these challenges, the customer journey becomes smoother leading to shorter conversion time and higher conversion rates.

2. Revisit leads that did not close during the previous year

Engagement is key to successful lead nurturing. Insurance providers should look back at the leads they generated the previous year and reach out to those who did not close. This provides an opportunity to re-engage with them and better understand their needs.

Marketers can re-engage them through email, phone calls, or SMS campaigns. They should craft messages more likely to resonate with customers and remind them why they should work with a specific insurance provider.

Personalization is key in this strategy. Marketers should customize thier messages depending on the information gathered from leads to better resonate with them and reduce friction points during the customer journey.

3. Utilize data-driven insights to improve lead conversion rates

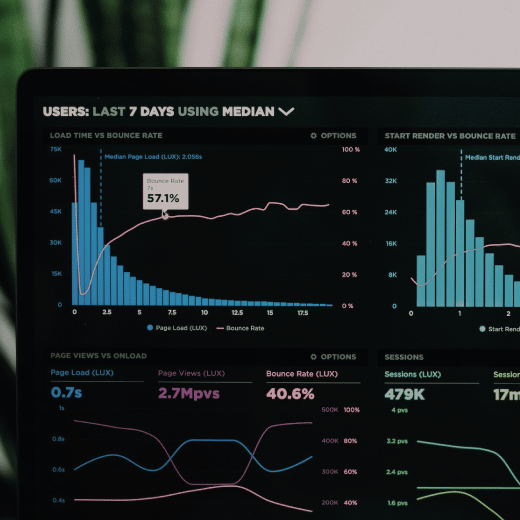

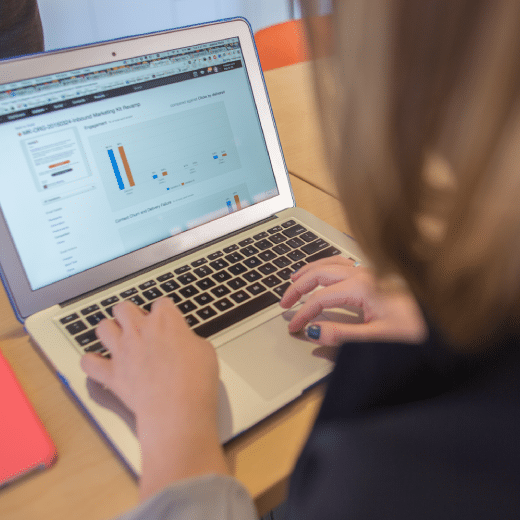

Data-driven insights can help insurance providers identify potential leads, increase conversion rates, and determine where to improve in lead nurturing efforts. With the rise of insurtech, insurance carriers, brokers, and MGAs have access to technology that can help them collect, aggregate, and analyze customer data.

They can use this data to better understand the customer’s needs and preferences. The data can also be used to craft personalized messages that resonate with customers and even leverage predictive analytics to identify high-value leads.

Marketing automation software can automate the creation and distribution of reporting analytics to marketers. The software can identify and track many digital interactions including when a lead visits a company’s website and the pages visited, opens an email or fills out a form. Automation platforms can leverage all this data to streamline the process of generating leads, nurturing them, and supporting the qualification process.

Stay on top of lead generation and lead nurturing with the right strategies

Lead generation and lead nurturing are essential for success in the insurance industry. Thanks to digitalization, insurance providers now have the tools to reach and engage with leads across the entire buying journey. With the right strategies, they can maximize lead conversion, leading to higher ROI and business growth.

Contact Us today to learn more about how Goose Digital can help with your lead generation and nurturing strategy!

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)