6 Key Customer Marketing Metrics for Insurance Providers: Part 1

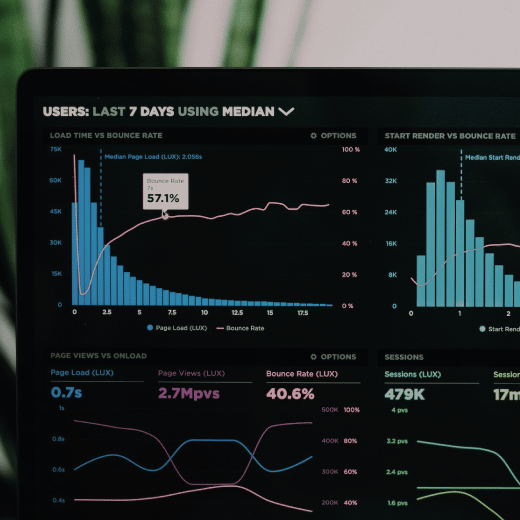

The Insurance industry has always been built on relationships. While this is still true today, what has changed is how these relationships are created, developed and grown, and how they are measured. The introduction of digital channels has expanded how, where and when Insurance providers and their customers engage; and equally as important, has provided improved ability to monitor and measure the success of these engagements.

Marketing Metrics provide Insurance providers the ability to assess the health of these relationships and based on results, develop strategies to further strengthen them.

As there are many customer marketing metrics available to Insurance providers, we’ve divided this blog series into 2 parts and are starting with the metrics critical to assessing awareness.

1. Email addresses on file

While this might not seem to be an obvious marketing metric, the percentage of customers with email addresses is actually one of the most important ones. Email continues to be the channel of choice, whether for a Carrier communicating with their Brokers, a Broker engaging with a customer around renewal time or the Go Paperless initiative currently impacting all stakeholders. These strategies are only effective when the provider has an email on file – one that is current and correct. If you only have 40% of contacts with usable email addresses, the ability to communicate is severely limited. Establish a goal, determined by your current email list and the type of customers being engaged with, create a multi channel strategy to capture additional emails addresses and monitor and measure the success of your plan.

2. Deliverability

Deliverability lets you know what percentage of your emails actually land in your audience’s inbox and has an impact on your reputation as a sender. As we’ve discussed in previous blogs, success is based on many digital and creative best practices and when adhered to should be at 97%+. Deliverability should be monitored for every email sent, and action taken quickly if there are issues. Poor deliverability can have a longer lasting impact on your reputation with a worse case scenario of your messages categorized as SPAM and being black listed. Remove undeliverable emails from your list, adjust subject lines, content or creative that may be blocking your emails from being delivered and monitor the impact on your future sends.

3. Open Rate

Open rates indicate if your audience has viewed your email. What drives open rates? Trust and relevance. Emails are more likely to be opened when they come from a known and trusted sender. This means using your company name or better yet the name of someone known to the recipient such as an underwriter, producer or assigned CSR. Relevance means ensuring your subject line is personalized for your audience.While this includes using the customers company name or first name, achieving relevance today has to go one step further. A generic message will feel cold to a known customer; leveraging data about their role and knowledge about their current coverage can significantly impact open rates. It’s the difference between a subject line that reads ‘Cyber insurance for you’ and one that reads ‘John, protect your family’s personal data with Cyber Insurance’. Create a testing strategy to assess what type of subject line is most successful, which may include sending on different days of the week and different time of day and keep track of the results.

“If it hasn’t already, customer marketing will become a fundamental part of your full strategy in 2021 and beyond. Think of it as a transition from digital marketing that attracts to digital marketing that retains. This is because communication is a primitive element to customer service. By building digital customer communication strategies and utilizing the right tools for distribution, you can design them to flow with your existing service timeline that you have already built, add in touch-points that you may not have otherwise had time for and build upon things like much needed education topics.

The result is delighted customers, full transparency and service teams that transition from surviving to thriving” – Jennifer Pugsley, VP, Customer Success at Goose Digital

Setting Benchmarks

Every Insurance provider is going to be at different stages of success, for each one of these metrics. It’s important that regardless of where you are, that you track your current metrics, establish benchmarks and goals and then put in place strategies and tactics to achieve them. Establish a culture where your teams understand what these metrics are, their importance to your business and the initiatives in place to improve them. And where you don’t have the expertise or technology platforms to implement the changes and measure these marketing metrics, work with partners who do.

And stay tuned for Part 2 in our series where we will dive into click through rates, engagement scoring and customer lifetime value.

Need help getting started measuring your marketing? We would love to help. Please Contact us for more information.

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)