Insurance Brokers, It’s Time to Fully Harness the Power of Your CRM

At Goose Digital, our CRM is basically our lifeblood, where we track prospects and leads from our front end and measure closed deals and revenue in our back end.

We use this integral tool for nearly everything from managing contacts to deal tracking, but marketing is our primary service. Our CRM aligns marketing, sales, and customer service, so it makes sense for us to heavily lean into such a platform to really drive our business forward.

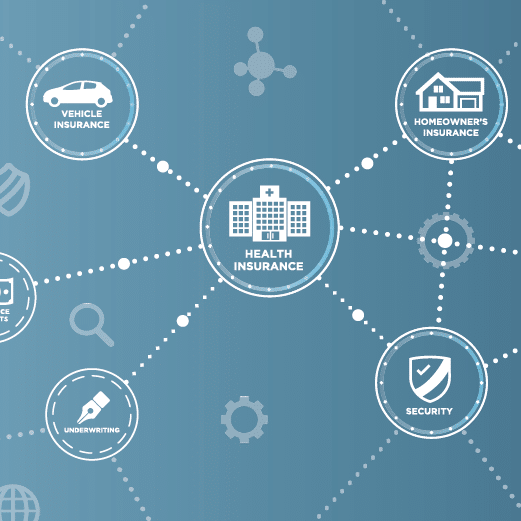

For many insurance providers, the value of a CRM may not be as obvious, initially. However, when viewed from the lens below, the ability of a CRM to enhance business starts to fall into place:

- Front-end customer integration

- New customer experience

- On-going communications with client/customer base

- Up-selling

- Cross-selling

While your brokerage may not use a CRM as extensively as a digital marketing company, you can still extract exponential value from it. In doing so, you can significantly impact sales and improve return on investment.

Prioritize Your Sales Pipeline Over Lead Generation

It used to be that brokers lived and died on lead generation.

But now, leaders in the insurance industry have come to realize the one-dimensional aspect of this approach. By solely focusing on how CRMs impact lead generation, you would be missing a big part of the whole story. Leveraging a CRM across the entire sales pipeline holds all the winning secrets and insights.

Let’s add some context:

Maybe you have a spreadsheet–as many businesses still do today–with all your leads, and you can attribute each one to a specific sales rep or producer.

This spreadsheet can paint a rather basic picture of where leads came from and perhaps a partial update of their status but it’s largely inconsistent. Chances are, if there has been forward movement those details are more likely to live locked up on the producers desk and won’t be recorded in this document.

Here’s where fully harnessing a CRM makes an enormous difference. It provides not only a platform to properly record and view activities associated with lead nurture but can also connect with other platforms that are designed to automatically take actions across the pipeline with all leads.

Evolving From Your Spreadsheet

We’re talking about predicting and being proactive with your pipeline. This is exciting stuff, but before we get there let’s look at some of the basics that need to be set up, and how CRMs and other MarTech platforms can manage these steps.

Prior to making any bold pipeline predictions, you need to figure out how to build your pipeline. Going from an Excel spreadsheet or notebook to a full-functioning framework and ongoing pipeline should be your top priority.

Combining Your Pipeline with Automation and CRM Visibility

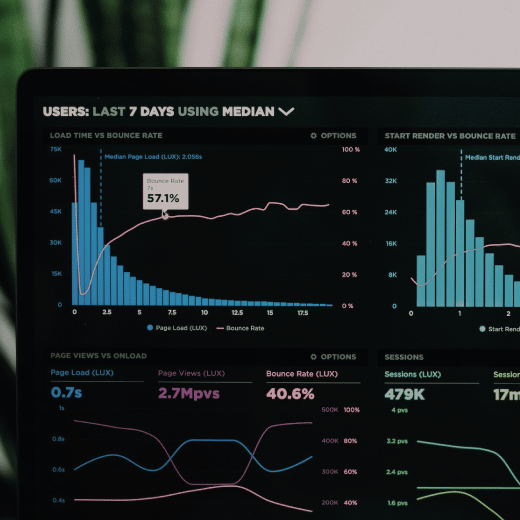

A CRM provides pipeline visibility, letting reps know where leads are within the sales funnel.

There’s then the power you can achieve from connecting marketing automation with your CRM. Your sales team has a lot on their plates at any given time; relying on them to manually remember to make calls or send emails whenever a lead reaches a specific stage just isn’t realistic.

By turning over that responsibility to a marketing automation platform (MAP), you are guaranteed not to miss connection opportunities with leads if they drop off at certain pipeline stages. Automated alerts can flag the right salespeople, who–from there–can take personalized actions based on the timely notifications to engage with your prospects.

The CRM sets the stage with its multi-dimensional visibility – enabling your team to always know where a lead sits within the sales flow and the impact of your sales team’s actions. And the more the two platforms are integrated the greater benefits you realize for your sales pipeline.

CRMs Are Designed for Your Success. Use Them.

You might have a CRM for your business, but chances are you aren’t using it to its maximum value.

What’s more, you wouldn’t be alone if you didn’t prioritize investing in your CRM, as it hasn’t been a traditional source of truth and power within the Insurance industry. It may be something you felt you “had” to purchase as a way to travel further into the digital age.

Far too often, the reason you don’t extract the most value from a tool like a CRM is that there’s not a 100% buy-in from everyone involved.

Here’s what you need to consider–CRM technology is very mature, having existed for close to two decades now. In fact, CRMs have proven so effective that businesses who invest effectively can see between 11% to 14% improvement in sales productivity.

But the only way you’ll experience the impact is by taking action – by using your CRM to support and improve your pipeline and help your team achieve their growth goals. Investing in your CRM has been proven to show results so don’t wait any longer to see how it can help your business.

Are you a Broker, MGA or Insurance Provider looking to get more from your CRM? Contact us today to learn more about how we can help.

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)