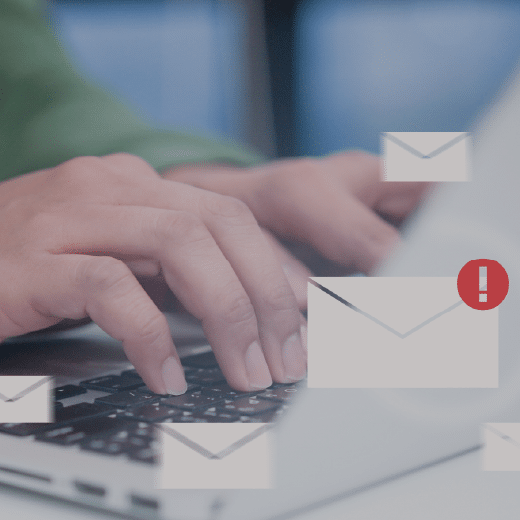

Balancing Your Email Strategy – The Critical Must Haves and the Warm and Fuzzies

Balancing Your Email Strategy – The Critical Must Haves and the Warm and Fuzzies

Rewind to the beginning of 2020. Many Brokers, Carriers and MGAs started off the year with carefully constructed marketing plans designed to engage with existing customers, drive new business and further communicate brand value to all stakeholders. And then COVID hit and campaign calendars went out the window. But what it did not mean for most insurance providers was a complete halting of all marketing communications. In fact, for many, there was an increase in the volume, cadence and breadth of subjects of their email marketing. Readjusting, refocusing and replanning had to be balanced with testing, listening and learning. No one had the right answer to marketing during a pandemic but insurance providers who saw strong engagement across their communications had a mix of what we describe as critical ‘must-have’ messages and more empathetic warm and fuzzies. These are some examples of campaigns we saw in market over the last few months and what we see as the next wave of marketing messages as we emerge from the height of COVID-19.

Critical ‘Must Haves’ Email

- Office Closures/WFH Operations

Carriers, MGAs and Brokers all rushed to get information out to customers about how they could reach them, with most companies sending everyone to work from home. Businesses with marketing platforms in place and email addresses of their customers were able to do so quickly. Many personalized messages with contact information for producers or assigned CSRs to facilitate direct communication if necessary. And customers wanted and appreciated receiving this first wave of information; engagement rates for many of these emails were well above their normal rates.

- Business Interruption and Vacancy Coverage

As the shut down continued, insurance providers began fielding more calls and emails about these coverages. Using BMS data and a segmentation strategy, some were able to proactively share information with just the relevant segments of customers. As the situation was still fluid, insurance providers didn’t have all the answers but were able to address many of the questions and concerns and reinforce the value of the continued relationship.

- Carrier Messages

As the insuring markets made decisions about changes to some Covid impacted coverages, such as premium reductions in auto coverage for reduced driving, it was critical to get this information out to the end Insured. In some instances brokers were able to disseminate the updates through their direct to consumer email strategy using segmentation to identify specific policyholders. In other instances, carriers emailed customers directly. Many had never sent such large volumes of email before but those that followed delivery and email best practices succeed with both high inbox placement and response – sometimes even exceeding their expectations.

- Key Product Information

Most insurance providers focussed their efforts on taking care of their existing customers and not on new business. But with a majority of the country suddenly working from home and often with technologies and platforms far less secure than in their offices, insurance providers began to see a demand around coverages such as Cyber and Life Insurance. Product emails, with content tailored to the current situation provided customers with details they needed and facilitated the purchase of coverages they wanted.

- Getting Back to (the new) Normal

With businesses starting to re-open and customers beginning to adopt a more forward looking focus, it’s important that insurance providers adapt their messaging as well. The next step in their email strategies should reflect what consumers are currently experiencing and want to hear about now, such as tips and tricks to open the cottage, intra-provincial travel protection guidelines, how to update auto coverage for increased use and what businesses need to know as they re-open. Finding that right balance will be important to keeping customers engaged.

Warm and Fuzzies

- Continued Commitment

At the outset of the pandemic, it was important for insurance providers to show continued commitment to support their customers. Many followed up the office closure emails with content that acknowledged the struggles that so many consumers were facing, including sharing their own stories of trying to balance work and childcare, tips on working from home for both leaders and teams and stress and time management advice.

- Brand Value

Some insurance providers wanted to go beyond messages of support and took action. Many of the larger companies made donations to food banks or charities both locally and nationally, and shared this in their email messaging. Others used hyper relevant incentives such as gift cards for food delivery services to drive adoption of self service platforms, ranging from document access to payments. Sharing both how to sign up and access the platforms and redeem the rewards as part of the email strategy demonstrated how in tune the insurance providers were to their customers’ needs. The rapid adoption of these platforms and response to the incentives validated the value for their customers.

- We Are All in This Together

Most messages doing the COVID period have been focused on the pandemic and given the situation, often heavy. Some insurance providers took a step outside their comfort zone and decided to share lighter, more lifestyle (COVID lifestyle, that is) content. Humorous yet on point stories of couples and families suddenly sharing spaces 24/7 resonated with customers and enabled many providers to continue relationship building through a somewhat different approach.

- Keeping Safe

Sharing safety guidelines wasn’t a new content focus for insurance providers but in the past had been largely tied to coverages. As customers started to go back to work and normal behaviours, a new content stream around making those activities safer emerged. This included checklists for cleaning the inside of cars and advice on where to keep hand sanitizer and masks handy to make navigating the outside world less strenuous and safer.

- Getting Back to (the new) Normal

Carriers, Brokers and MGAs who included warm and fuzzy emails during the height of COVID-19 saw from engagement numbers that customers welcomed this type of messaging. They are integrating this softer approach into the ‘getting back to normal’ messaging with blogs and articles that are positive and forward thinking.

“Like most of us, insurance customers see their inboxes flooded daily. You’ll always have necessary communications that are on your content calendar, but if you’ve been running email for a while, it’s a good idea to take a step back and assess, profile and clean your audience lists. This will help you build superior content strategies that boost targeting and help you cut through the noise” – Jennifer Pugsley, Director of Client Services, Goose Digital

What We Have Learned

For insurance providers who continued an email marketing strategy over the last few months, there were many invaluable lessons learned. They saw that customers relied on them for updates about changes in coverage but also expected to hear about additional ways they should be protecting themselves. They realized that being empathetic went beyond just messaging; taking action and communicating that out was also extremely important. They learned that multiple content streams were important to build and sustain their relationship through email. As the situation takes yet another rapid turn, this time for the better, it’s a great time for Carriers, Brokers and MGAs to take a pause and reflect and evaluate the next phase in their email strategy. Relevance, personalization and measurement have never been as important and having the right platform to sustain the cadence and mix of content as well as measure customer engagement will be essential for providers to successfully balance their email strategy going forward.

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)