Insurance Brokers: Focusing on Growth Today and Tomorrow

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

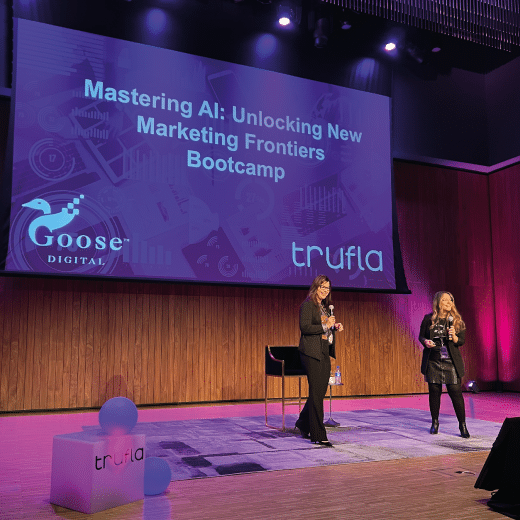

At Goose Digital, we’re no stranger to how the insurance industry has been challenged with adopting digital marketing to help drive growth.

Moreover, while working with our insurance clients, we’ve learned that brokers are trying to balance retention via strong customer relationships with the need to invest in driving net new business.

In many respects, Insurance is all about the future. It’s about managing and mitigating future risk and has been and will continue to be impacted by Innovation. One has only to look at changes in both the automobile industry and Cyber to see this.

Yet, insurance is also very much about today and existing customers and coverage. These two focuses, while seemingly opposite, don’t necessarily have to be. That’s because investing in an existing business doesn’t mean being exclusively tied to legacy ways of communicating with customers or selling and delivering products and services.

But this is where we often see insurance providers grappling with the ‘here and now’ vs the future. The reality is that in order to grow, attention needs to be paid to both. And introducing digital marketing innovations to improve upon resource intensive traditional marketing – which is of lessened value to both existing and new clients – is the only way for insurance providers to succeed. And that is as true for today as it is for tomorrow.

That’s not a knock. It’s a reality and a necessity. Brokerages must understand that many customers – including their existing ones- have changed in how they want to be engaged from both a sales and service perspective.

Insurance brokerages who have learned that they must combine past and present-day with today’s innovations are in the best position to manage the future.

Insurance Is All About The Future

Brokers who have a keen eye on the decades ahead, already understand the value of digital innovation.

Some things will never change. The value of a broker is to be a trusted resource for their clients, able to understand their pain points and concerns. What has changed is how a broker can share their advice with their clients through the adoption of marketing technology and other digital tools.

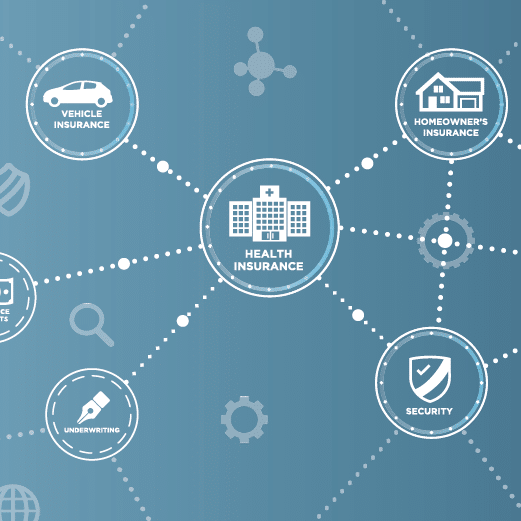

If we go back to the auto insurance industry example: The mega-trends are all about innovations, whether electric vehicles, telematics, autonomous automobiles, ridesharing, etc.

These mega-trends materially impact the level of underwriting risk and experience. Brokerages must grow alongside what they insure and the customers/clients they serve.

The challenge? Finding the best ways to manage these new innovations while continuing to provide the same customer expectations.

Insurance Is Also About The Here And Now

It’s impossible to succeed with a future strategy when there isn’t once in place to manage the present day.

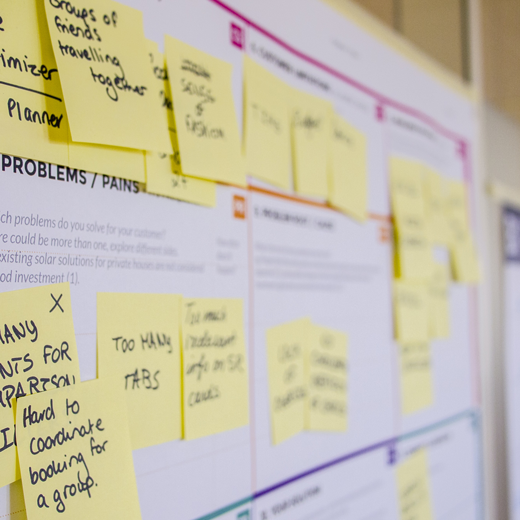

Near-term needs formulate your long-term strategy because today’s customers and their needs provide guidance for tomorrow’s.

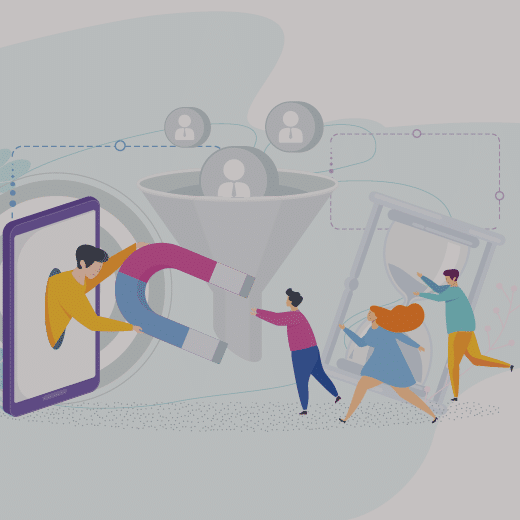

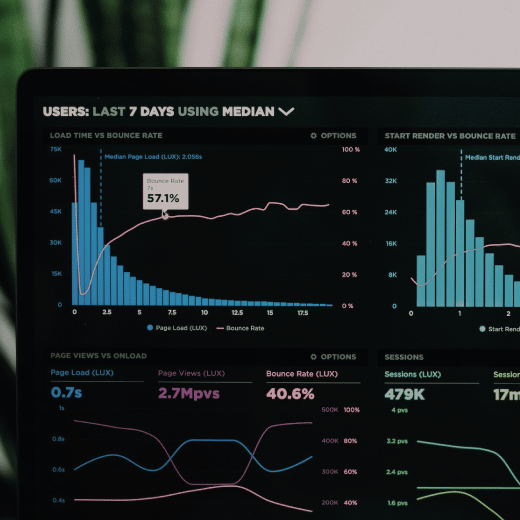

For example, some of our clients are using analytics and machine learning models to better understand their existing customers. Those findings are then being leveraged through and then predictive analytics to craft highly targeted marketing initiatives to attract the type of customers that they want.

This same exercise also provides them with valuable insights into how to better service their customers of today, again balancing the two equally important opportunities for success.

Analytics, data, and insights garnered by today’s innovations will shape that research intended to help plan the future.

Combining The Future And The Present

Operating in two timelines means laser-focus on two areas.

You may need to prioritize your focus on today if that is an area of risk so you can continue surviving and thriving into the future.

But at the same time someone on your team will always have to have an eye firmly fixed on the future. To not do so opens you up to being surprised by one of the many innovations that are continuing to impact both the insurance industry and marketing as a whole.

Digitally Opportunities For Brokers

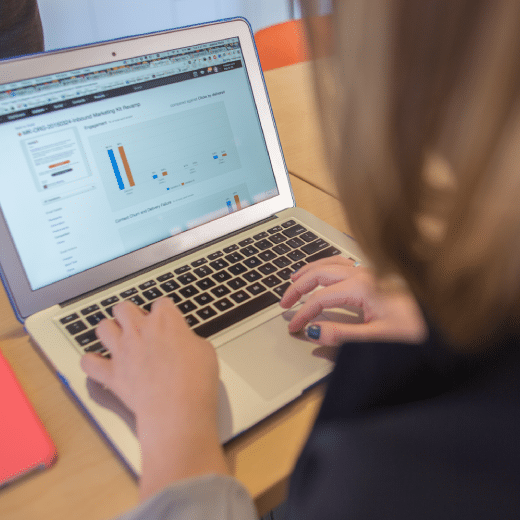

Today’s brokers have a myriad of opportunities with marketing, automation and technology. But many of these require a certain level of experience and expertise in order to see their true business value.

As an example, managing Google–so to speak–is a full-time job in and of itself. Unless you have a dedicated resource capable of deploying and managing digital ads and associated budgets in line with your business strategy, this will be challenging to achieve. Understanding Google’s algorithms, improving your SEO and integrating the constant change and updates can easily be a full time job. Assuming this can be accomplished along with high priority broker related tasks is where we often see our clients be disappointed and fail.

There’s also the need to reconcile the difference between localized offline strategy and online strategy.

Jumping from the small local pond into the vast online ocean (even if that ocean is just a province or state) has both risks and rewards.

Fortunately, such challenges can be conquered. As your marketing partner, Goose Digital can provide guidance on how to build and integrate a digital strategy and technology innovations to support both your present day business while keeping one eye on the future. Contact us today to find out more.

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)