Benefits of Marketing Automation for Insurers

Many industries are struggling to keep pace with increasing customer expectations and the evolving digital landscape. The insurance vertical is no exception.

Insurers often promote and sell a variety of product lines, and each of those usually have multiple policy types. So they’re frequently tasked with appealing to a wide range of target audiences. Unfortunately, lacking access to the proper digital tools makes it extremely difficult to deliver the caliber of compelling prospect and customer experiences that build trust and loyalty.

Done manually, there are just too many tracks to create, manage, and optimize. With marketing automation, however, insurers can meet and exceed their goals by streamlining workflows and delivering tailored messaging, content, and campaigns. When maximized to its full potential, it becomes the cornerstone of any successful insurance marketing strategy.

Keep reading to learn the many benefits of marketing automation for insurers!

Personalize Your Marketing to Target Prospective and Existing Policyholders

Everyone has unique insurance needs that they expect their insurer to recognize and be able to solve — even before they have an actual conversation. As such, providing valuable messaging and content has become increasingly important to prompt engagement and establish relationships. These assets should keep prospects and policyholders moving through the sales cycle, helping to gradually build trust to the point where the insured feels comfortable placing their insurance needs in your hands.

How do you accomplish that? Personalized messaging. And what enables you to provide the right content to the right person? Marketing automation, of course. (Well, these two things and a solid strategy.)

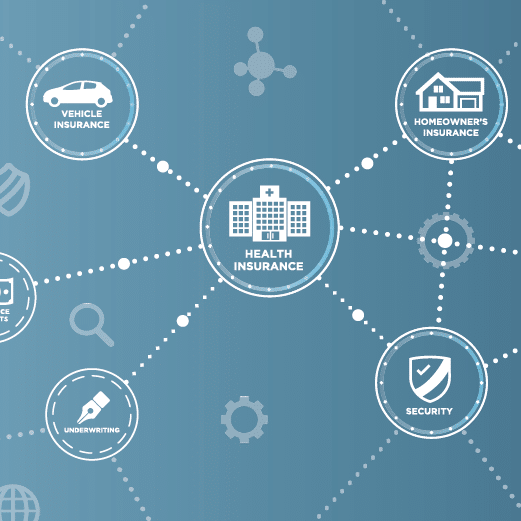

Maximize Cross-Selling Opportunities

Cross-selling represents a significant opportunity that can be realized with minimal resources. The probability of selling to an existing customer is 60-70 percent, while selling to a new prospect is 5-20%.

Insurers nurture their customers along the cross-buying journey with marketing automation by addressing which additional policies are best suited for their circumstances and why. Marketing automation empowers users to segment current customers and determine which policies are most applicable for them, ultimately leading you to cross-sell the right policies to the right customers.

Efficiently Convert Prospects

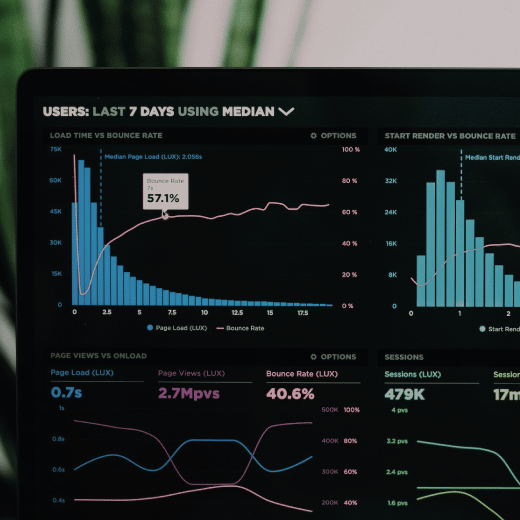

When leveraging marketing automation, you’re not blindly selling to prospects; you’re determining where they’re at in the sales cycle through multi-channel lead scoring and real-time engagement alerts. You know which emails they’ve opened (and when), which webpages they’ve visited (and when), which social media posts (and, ahem… when), and much more, which helps you gauge their interest level and pinpoint their location in the sales cycle.

Think about how much more informed you are as an insurance professional going into a conversation when you know where the prospect is in the sales cycle. Are they still in an introductory/information-gathering phase? Or have they learned more about your products and services and are ready to begin discussing purchase points? For instance, if you know they’ve read a blog, clicked on a link to a policy page, and downloaded an infographic, they’re likely at the stage where you should reach out to provide more relevant information and make yourself available as an invaluable resource.

Automate and Expedite Manual Tasks with Marketing Automation

It goes without saying that automating manual tasks saves valuable resources, but just to put things in perspective, a recent report on insurance agents found that 21.22% of agents know they need to stay in front of their network but don’t have enough time.

And all the while, marketing automation helps to cultivate, foster, and forge the necessary trust between insurance professionals and their prospective (and current) policyholders.

To read the full blog on how marketing automation can help your insurance business succeed. visit our partner Act-On Software, here.

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)