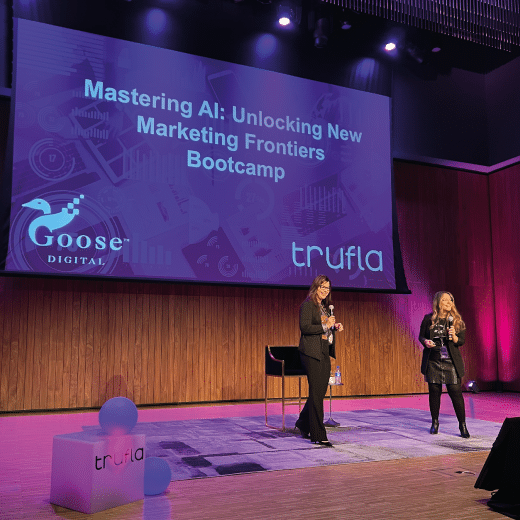

Top Takeaways and Insights from IBAO 2019

To say October is a busy month in the Canadian Insurance industry is an understatement!

Last week IBAO held their biggest and best conference yet. But it wasn’t just the organizers who challenged the expected. Brokers and Insurers made it clear that they are ready to focus on what is really important to ensure the growth and continued success of their businesses. Unsurprisingly technology and digital were part of almost every conversation.

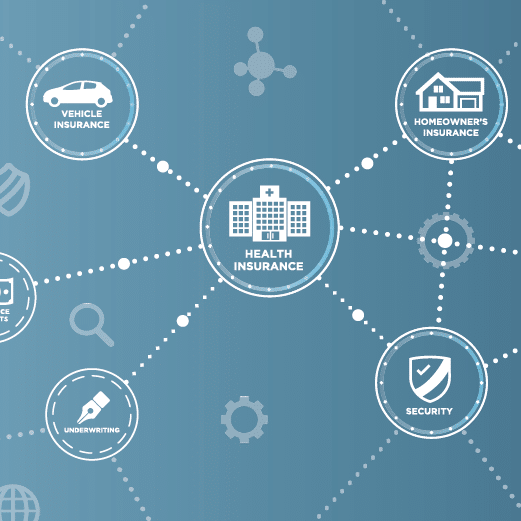

- Witnessed by an engaged audience, Insurance CEOs unanimously agreed that APIs (instead of portals) are the way to true connectivity. Each of the leaders who spoke confirmed their organizations are well down the path of development.

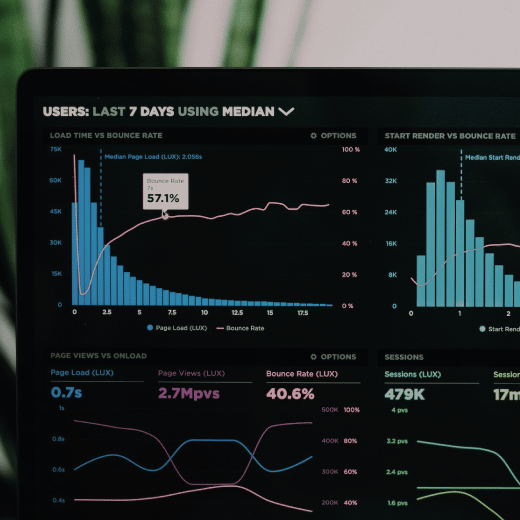

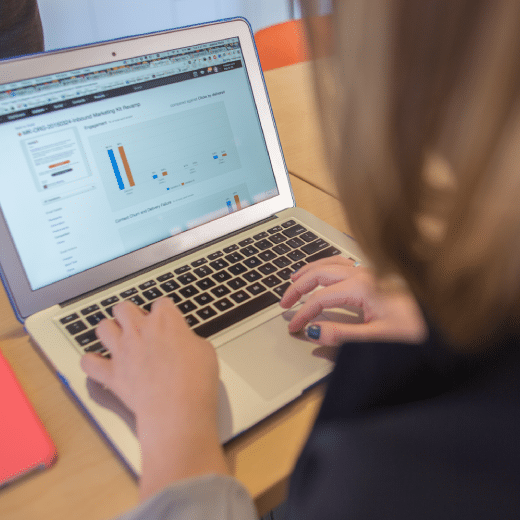

- Carriers are looking for ways to support their broker partners in a strategic manner. However, they’re also expecting more strategic thinking from their partners. Long over are the days when Carriers would write a cheque and assume the money was being used effectively. Now, there is an expectation of a well developed plan which includes multi-channel campaigns, digital tools/capabilities, KPIs, benchmarks and reporting to provide visibility and accountability.

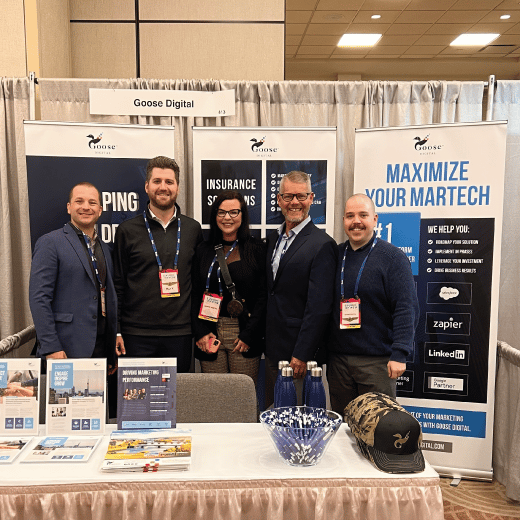

- Alongside this was the recognition that partners are the key to driving digital success. Brokers, MGAs and Carriers are experts in their fields and understand the value they offer their key markets. However, digital transformation, digital strategy and the supporting technologies are often outside that area of expertise, and instead of investing valuable effort in trying to figure it all out, there is a growing interest in partnering with companies who have strong digital expertise and deep knowledge of the insurance industry.

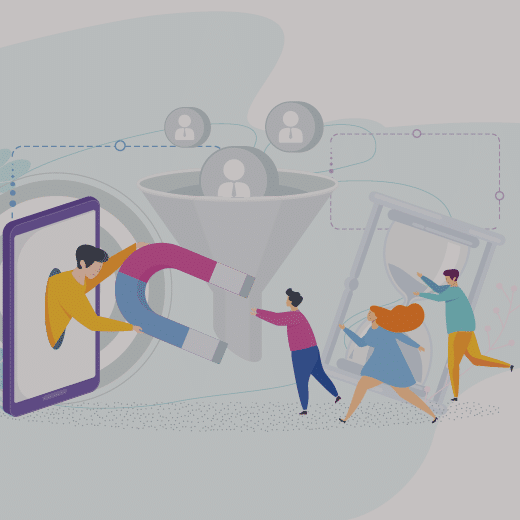

- It’s no secret that we are in a hard market. Yet, there were far more conversations about how to manage leads than the challenges of finding them. While the insurance industry isn’t as familiar with terms such as marketing qualified leads (MQLs) or behaviour scoring, they were definitely talking about the need for solutions to help manage the volume. It will continue to be critical for Brokers to have the ability to identify and engage with the right leads and have the tools/processes to ensure they are not missing any opportunities.

- I was able to count the comments about digital ‘not being right for my kind of business’ on one hand. This evolution has been years in the making. At IBAO there was an overwhelming acknowledgement that digital has a place in everyone’s business, regardless of who your customers or employees are and how you sell and service them. Brokers finally understand that introducing digital into a business does not mean abandoning everything they have done before but instead, means identifying opportunities to optimize everything from driving new business, to operations, marketing and customer service.

- Digital marketing isn’t just about driving leads. We had numerous discussions about leveraging data and automating marketing reach outs for relevant cross selling, scheduled renewal programs and ways to use referrals. Customers don’t equate the value of their broker with the volume of paperwork they receive but with the quality of advice and accessibility to expertise.

- And finally, there were many brokers who told me that they had tried a few digital tactics but they hadn’t worked. A few years ago, the conclusion would have been “digital doesn’t work for us”. This year, the evolved mentality is “we need to find a way to make this work because digital does work, when you have a strategy, the right platform and the right partners.”

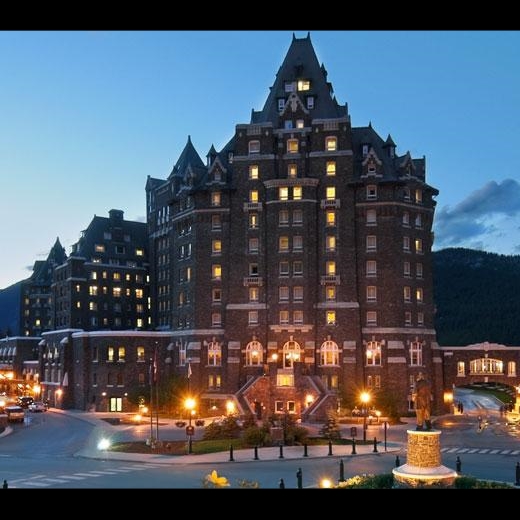

This was IBAO’s 99th year. Based on the size and quality of the show, as well as the interest from Insurers about embracing new ways of doing business, the stage is set for the 100th year to be incredible.

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)