Using Your Renewal Process As A Retention Strategy

The Challenge

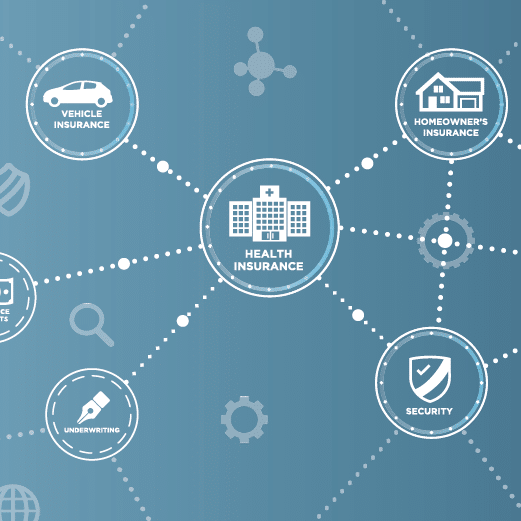

Renewals are arguably the most important touchpoint for a broker. If you don’t handle it well, you could put that business at risk. But, if you do succeed with the right conversation on the right channel at the right time, the result is likely to be a satisfied and loyal customer.

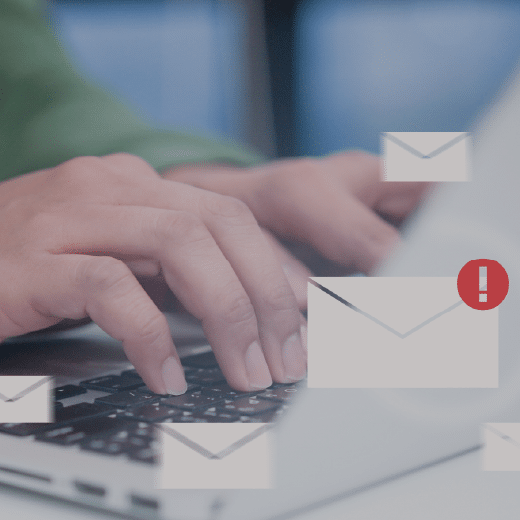

No matter the size of the broker or the number of policyholders, it’s just not possible to engage with every client at renewal time. Add in the fact that some of your clients would be very happy with just their renewal paperwork while others very much want or need to speak directly with their broker. Lastly, the hard market we are in makes it even more challenging and time consuming to provide each renewal the attention it may need. Ensuring that the right type of communication, using the right channel while not missing opportunities can make an effective renewal process very challenging for most brokers.

What Your Customers Want

Ask most of your customers, and they will likely respond – choice, convenience and value.

They want to be able to choose if they engage directly with you, or not. And they want to choose the channel – email, text, phone or face to face meeting.

They want a quick and efficient process; but convenience means different things depending on the nature of their policy, the channel they choose and the level of advice and education they are seeking. Requesting updated revenue and business details by email for a commercial policyholder may work for one customer, while booking a phone meeting to discuss the decrease in Auto coverage may be what is right for another. In either case, as a broker, the ability to offer that choice, convenience and advice on an individual customer level is a value that is hard to match by any direct writer.

How to Build an Effective and Efficient Renewal Strategy

As a broker, you have all the information you need to build an effective strategy, in your BMS. Really, all you need is a list of your insureds, their contact information and policy details such as product, policy number and effective date. For example, you could run a report that identifies everyone with a policy that expires in 90 days. You could run this report daily. And you could run another one for policies expiring in 60 days. Then another for those expiring at the 30 day mark, and split the report into commercial and personal policies. And then hand then off to producers and CSRs, for them to make phone calls and follow up until they reach the client. Of course then you would want them to report on their progress….

Theoretically. But not really.

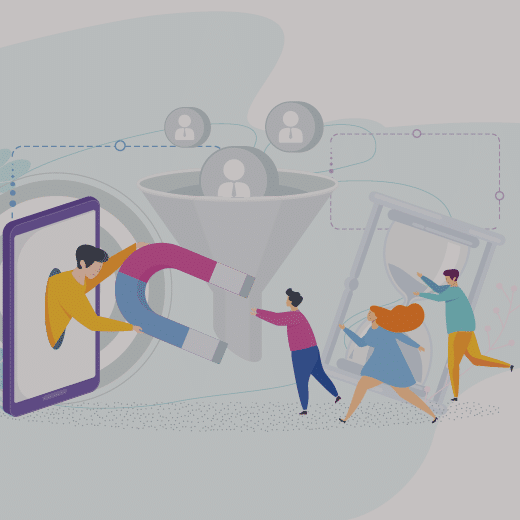

Or, you could start with that same list.

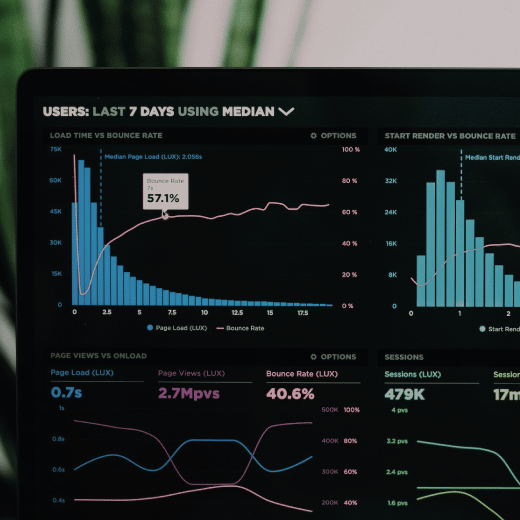

And set up an automated drip program in a marketing automation platform and segment it by product line. This program would automatically email your customers at 90 days, then 60 and 30 days (or a cadence of your choice) from their policy expiration date and until they take action or the policy auto renews. It would include personalized messaging, including their policy number, policy type, requests or updates and signed by their actual CSR or Producer. This message would include links to connect via email, text or phone and the ability to book a phone or in-person meeting using a calendar embedded in the same email.

And then wrap this all up with a convenient monthly retention report that not only you as a broker can view, but can be shared with managers and broker principals

Really, not theoretically.

The Opportunity

As a broker, you know the value you can bring to your customers, especially at renewal time. That conversation – regardless of the channel where it takes place – provides a personal connection and an opportunity to show the value of your relationship. And that perception of value is what drives retention. It’s a win/win situation.

Key Takeaways:

- Automating your Renewal Strategy using a marketing automation platform is the best way to ensure you reach out to every one of your customers as their renewal date approaches, without adding extra work for your sales and CSR team.

- Adding in Digital channels provide customers the choice they want and makes it easier for you to connect with them.

- Customer retention is largely driven by feeling there is value in a product or service- renewal time is a great opportunity to showcase the broker value.

- Retention efforts build loyalty and loyal customers are your best brand advocates and referrals

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)