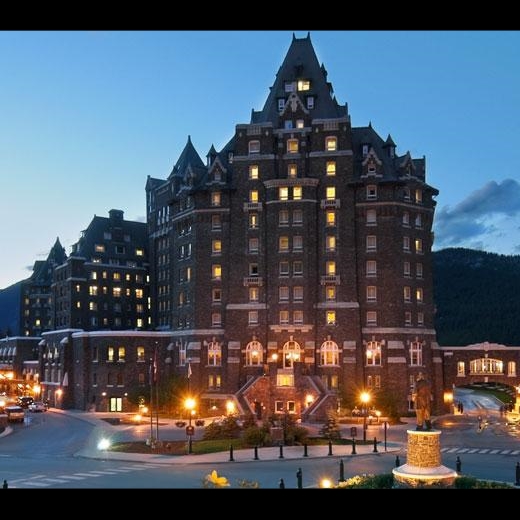

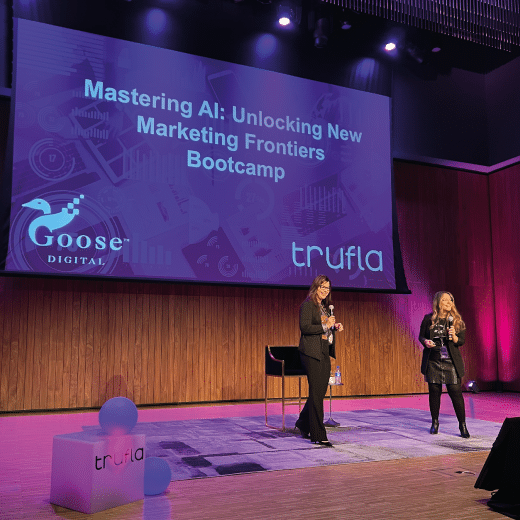

Let’s Recap: ICTC 2019

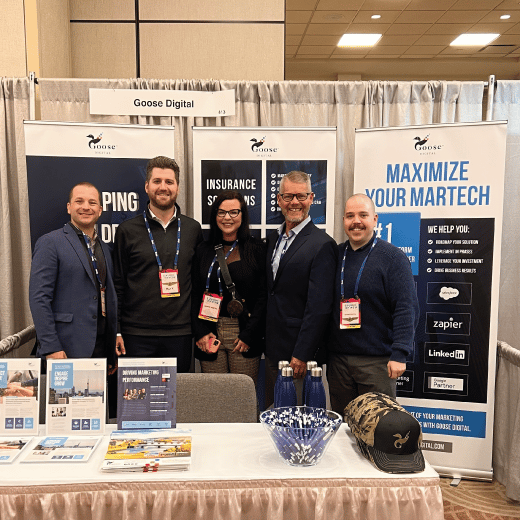

We are just back from 2 jam-packed days at ICTC 2019 in snowy downtown Toronto.

Another great conference, with conversations about digital, technology and what the future holds for the insurance industry. Over the next few weeks, we will be delving deeper into these topics but here are my top 3 takeaways from the show.

- Brokers are looking for ways to better engage with both leads and customers. Personas, buyer journeys, data, personalization and social media were heard in several presentations. For more traditional brokers, transforming and adopting these strategies across their businesses can be daunting but they have become mission critical. But the good news is that those who do embrace this are seeing success. And there are partners out there who understand both digital and insurance and can help.

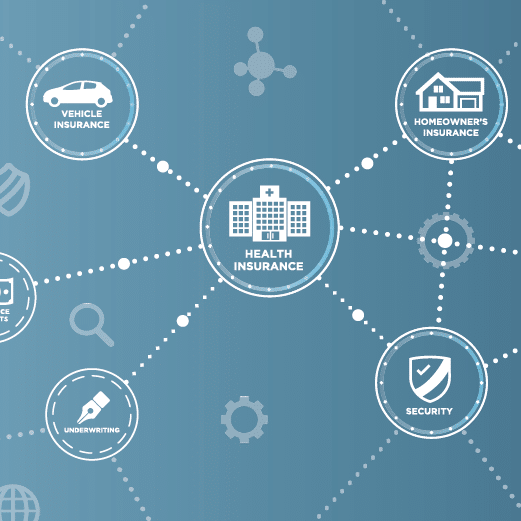

- There has been some exciting movement in the broker-insurer connectivity struggle. While IBAO continues to forge ahead with creating industry-wide guidelines and building a technical framework, some providers – both brokers and carriers – are starting to carve their own path. They are investing heavily in their own digital transformation and partnering with their key markets on platform technology and strategy. These providers are aware of how their innovations will benefit the end user by improving their buying journey and improve efficiencies for both broker and carrier.

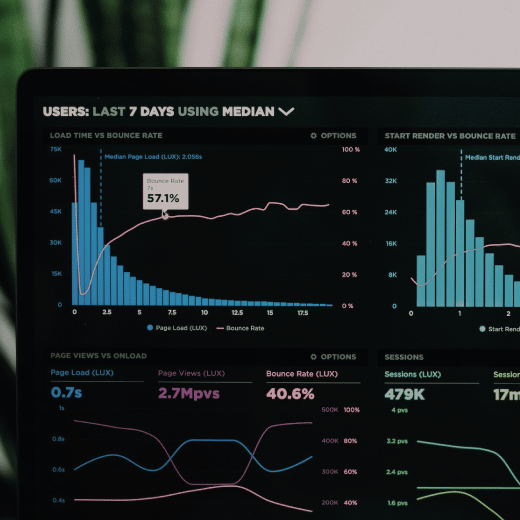

- How the industry will look in 10 years is still a guess – but brokers and carriers need to start transforming now or they will miss a ton of opportunity. While I won’t deny that I did hear AI, blockchain and machine learning mentioned during the sessions, more prevalent was the discussion around marketing automation, reporting and measurement. While less sexy, these are the tools insurance providers can implement right now – and start seeing value very quickly. Once they are in place and there are a few years of data and learning – that’s the time to start thinking about these more sophisticated platforms.

I am looking forward to exploring these topics further and discussing how we can help insurance providers move forward with their digital transformations.

![[Blog] Insurance Brokers: Focusing on Growth Today and Tomorrow](https://goosedigital.com/wp-content/uploads/2022/05/Featured-Ins-Brokers-Future.png)

![[Blog] How Marketing Automation and Data Can Be Your Insurance Brokerage’s Key Difference-Makers](https://goosedigital.com/wp-content/uploads/2022/03/Featured-MktgAuto-Data-Ins.png)